Preparedness isn’t just found in grain buckets or backyard chickens. It’s a lifestyle of planning ahead. It’s a mindset. You really don’t want to read a blog about retirement savings right now because…well…there’s nothing “sexy” about it, nothing fun when you know how hard it is to save. But I’m going to share something fun that will give you a game plan.

Wilson and I are extremely frugal people. There have been times in life when we were doing just fine financially, and times when we had dinner because I pulled potatoes out of the ground that morning. It is not a secret that paychecks barely keep up with the cost of living, if they even do.

When at our poorest (and we’re riding that end of the spectrum these days), Wilson and I have been easily annoyed at a lot of modern financial advice. I am sure it is aimed at someone, but it never felt applicable to us with advice like, “What you need to do is cancel your magazine subscriptions, cable t.v., and stop buying a Starbucks everyday.” When you don’t have time to read a magazine because you are working two jobs and homeschooling, when you don’t even own a television, and your last Starbucks was from a gift card you got two years ago (and you struggled to even enjoy it), that type of advice is a hard pill to swallow.

Are you tracking with this?

The frugal lifestyle has been the best way for us to make it, reasonably.

Reuse, reduce, and recycle…

Use it up, wear it out, make do or do without…

Barter, make it yourself when possible, buying in bulk, and getting really creative…

These are big reasons why we love sharing our kitchen self-sufficiency tips with you. We know that they help you eat the way you need to eat for far less money. People who need to eat gluten-free save thousands of dollars a year by milling their own gluten-free flours instead of paying for stale gourmet bags with the fancy label. Making your own apple rings, banana chips, and fruit leathers mean less unnatural ingredients, better flavors, and serious savings!

One thing we’ve also hit a time or two on our blog is the idea of retirement When you barely make ends meet, you know you cannot put as much money aside out of every paycheck as you want.

MMM,hhhmm….I’m preachin’ to the choir.

I was asked to tell you about this retirement calculator thingy through the AdCouncil (I’m not paid for this blog—I’m “donating” it to help provide a free app to you). Anyway, before I knew I could support it (I’m not sure how I feel about AARP completely, and they’re in on it), I decided to do it myself.

This might not be rocket science to you—hopefully it doesn’t fall into the useless category the “cancel cable t.v.” lands—but I learned some things I didn’t know. I realized that it is not just about how much money I’m setting aside, but that even the age I officially “retire” by taking out social security has a major impact. I did not know that they reward you for waiting until 70 years old. That means that I can adjust my life plan now and create a realistic picture of what my needs will be then.

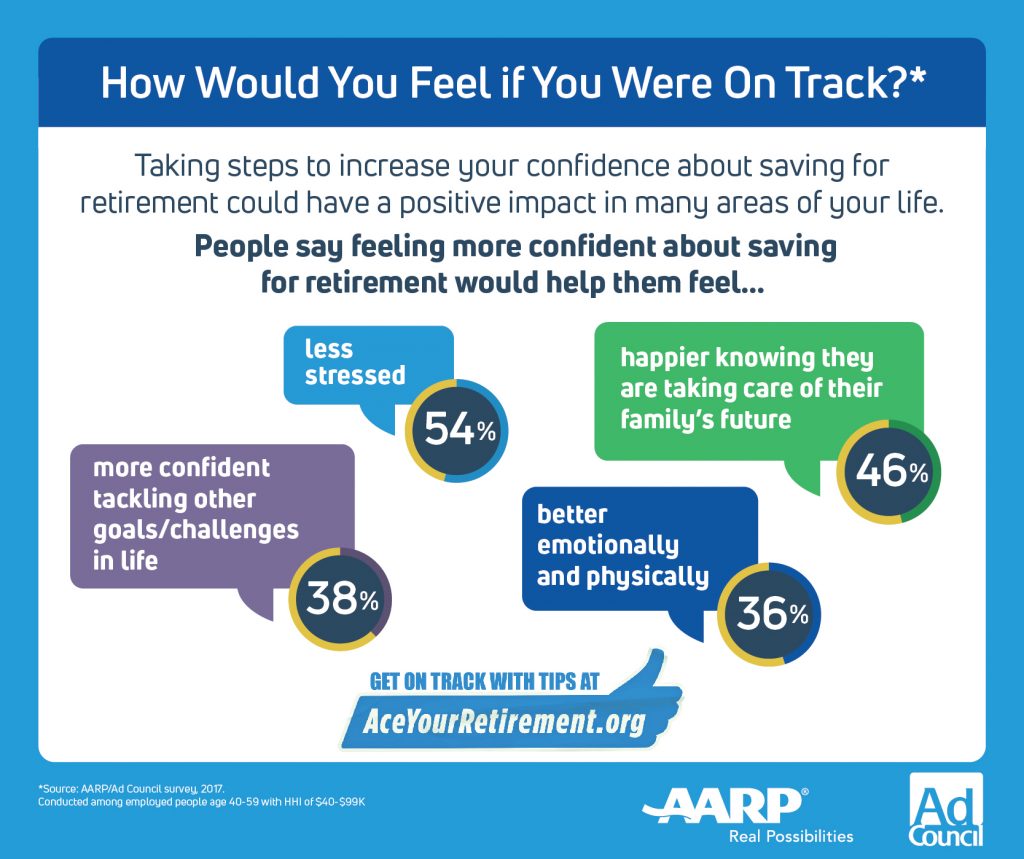

That was just me. There were other action steps for me to take now that can improve my retirement situation that went beyond “save more money.” In a culture where most people are not planning ahead, this is a very practical way that you can prepare for yourself and your family.

Take three minutes to try this app, and I thought it was pretty darn’ cute! It was something with the way they designed it—it was really painless. It didn’t require I go look up information to plug in numbers. It didn’t get “too personal” if you know what I mean. It just provided solid information that I myself did not know.

Open this link in a new window and take a few minutes. Think of this as an interactive blog. Then come back and leave a comment, telling me what you thought, what you learned, and how you’re feeling about this extremely important (and often forgotten) facet to a prepared lifestyle!

I’m 29 but I’m not good at saving money, so perhaps I should start now so that I have ANY savings by the time I should retire 😀